To record a cash receipt from the vendor:

Select Clearances |Clear Cash Receipts/Writeoffs.

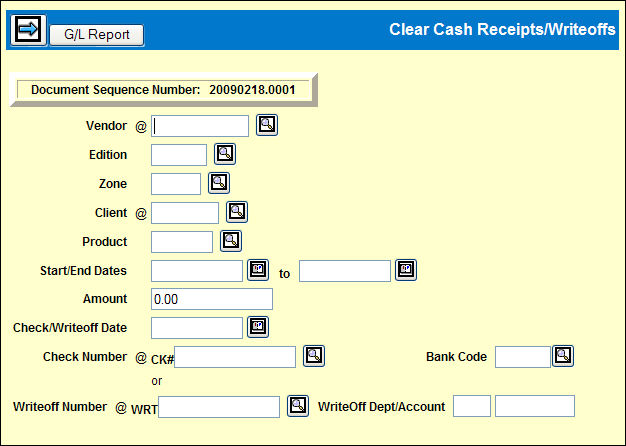

Clear Cash Receipts/Writeoffs Prompt.

Key or select the Vendor.

Key the optional Edition and/or Zone to limit the insertions/adjustments that display.

Key or select the Client.

Use the Start/End Dates fields to key the date range for the insertions to be displayed on the detail window.

Key the Check Number using only digits. CK# is automatically added to the number for tracking purposes.

If the receipt is a writeoff, key the Writeoff Number using only digits. WRT# is automatically added to the number for tracking purposes. Note that when entering a writeoff number and account (both are needed to ensure an appropriate funds allocation), all functionality that is currently in place for Clearing Cash Receipts remains the same. G/L hits are the same and records update the files accordingly.

Key the Check Amount and the Check Date/Writeoff.

Key or select the Bank Code, or key the next field.

If this transaction is a writeoff, key the Write-off Account to be used in posting the receipt.

If the G/L account has been set up at a department level, key the department and the associated write off account in the WriteOff Dept/Account fields. If the account has been set up at a department level, an error message displays if this department code is not entered. Accounts without department level designation will not require a department number.

Click the Next icon ![]() to display

available debits and credits on the Cash

Receipts Detail window.

to display

available debits and credits on the Cash

Receipts Detail window.