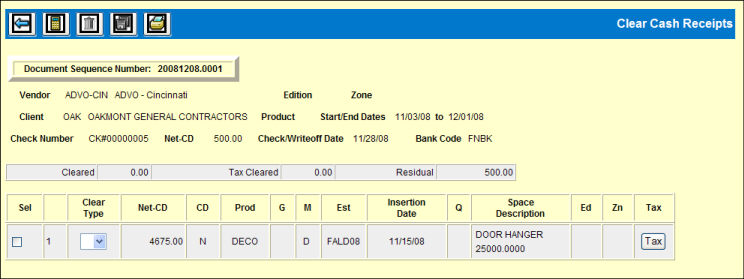

For a new cash receipt, this window displays all debits and credits meeting the criteria keyed on the Clear Cash Receipts Prompt window. For an existing cash receipt, the window only displays items previously applied to this cash receipt. Use the scroll bar at the right of the table to scroll down to see additional items.

Clear Cash Receipts Detail Window (Cash Receipts)

Clear Cash Receipts Detail Window (Writeoffs)

For each adjustment being applied to this receipt:

Select X from the Clear Type drop down list.

Click the Save icon ![]() to save

the cash receipt.

to save

the cash receipt.

If there is a difference between the Net-CD Amount and the Cleared amount, the Suspense/Writeoff Account window displays.

Suspense/Writeoff Account Window

If the suspense account has been set up at a department level, key the Dept code then key the Writeoff Account. Accounts without department level designation will not require a department number.

You may not clear more debit amounts than credit amounts. There must be either a zero balance or a credit balance, which must be less than the amount keyed in the amount field.

Tax Override Window

If you click the <Tax> button at the end of a Cash Receipt record (row) the Tax Override window displays. If there were a tax on the cash receipt, that tax code would display in the Tax Code column and the Tax Amount in the second column.

To make an adjustment in the tax amount, key the calculated tax in the Calculated Tax column.

Click the Save icon.