The Job Maintenance Entry Window must be completed before you can set up nonbillable information. See Workflow|Maintenance|Job Definition|Job Definition or Production Maintenance|Job Maintenance|Enter Change Delete Jobs. This function allows you to enter information for nonbillable jobs such as jobs for new business, promotion jobs, and house jobs.

Click <Nonbillable Information> on the Job Maintenance Entry Window to advance to the Job Nonbillable Information window.

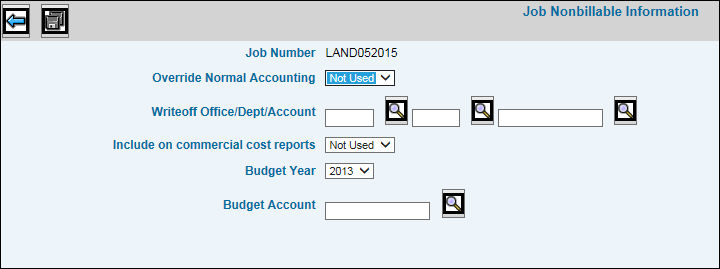

Job Nonbillable Information Window

Select the applicable response from the Override Normal Accounting field. Select Yes to use a specific account during the writeoff process instead of using the writeoff account set up in your Agency Profile. A write-off account is used when a reduction or depreciation of the entered value is required.

Note: Do not select Yes if you are working with a Deferred Income amount. The Deferred Income has no cost associated with it and, therefore, amounts do not post to any write off account. Select No for the system to read the deferred income account in the transaction code records

If your response was Yes to Override Normal Accounting, key the Writeoff Office code, Department, and Account code to use for the writeoff process.

Select the applicable response from the Include on Commercial Cost Reports field. The Commercial Cost Report is specifically designed to report only those jobs that you specify here. Select Yes for all charges written off to appear on client service expense reports.

Key the year in which to report the costs of this job then key the budget account number to which the amount should be posted.

Click the Save icon ![]() .

.

Once a nonbillable job is set up, a red flag stating that the "Job is Not Billable" displays at the top of the Job Maintenance Header Window.