Miscellaneous cash is non-client cash received by an office. Examples of miscellaneous cash could include an employee payment for personal telephone calls, rental income, sale of an asset, sale of stock, or rebates.

Select Accounts Receivable|Cash Receipts Processing|Enter Cash Receipts.

Follow Steps 1 and 2 of Entering Cash Receipts.

Select Misc Cash from the Payer Type drop-down list. Action and Payer Type fields are not applicable to Miscellaneous Cash.

Key the Reference code and Amount of the check. Accept the default Date and Bank (based on the signon Company/Office) or select a Date and Bank code

Click the Next icon to display the Miscellaneous Cash (non-client) Distribution Window.

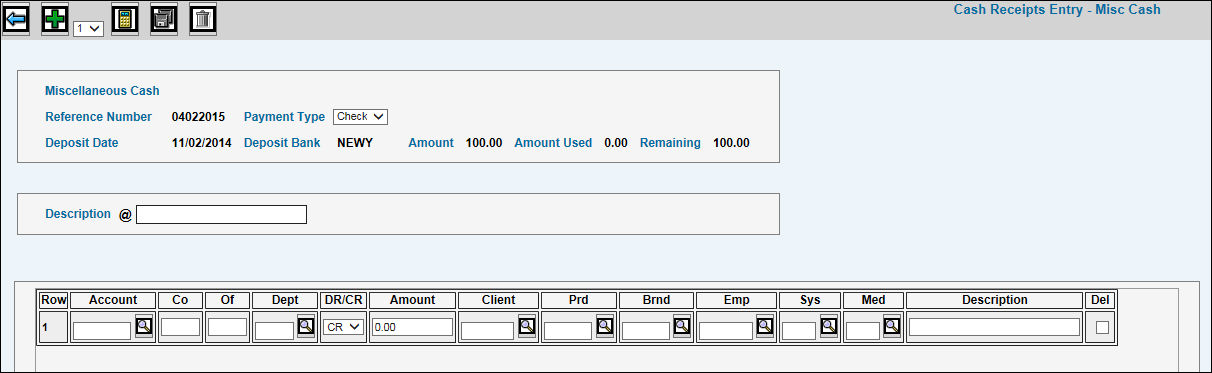

Miscellaneous Cash Distribution Window

Select the Payment Type from the Payment Type drop-down list. Payments can be in the form of a Check, Cash, or Wire transfer.

Key a Description for the Miscellaneous Cash received for identification on reports.

Key/Select the G/L Account number to credit/debit for the miscellaneous cash.

Key/Select the Department code, if any, to credit/debit for the miscellaneous cash.

From the DR/CR drop-down list, select DR to debit the account/amount or CR to credit the account/amount.

Key the Amount of the miscellaneous cash.

Key/Select the Client and if applicable the lower levels associated with the client.

Key/Select the Employee code, System code, and Media code if required.

Key a description of the line item in the Description field. If a description is not keyed, the description displayed in the Description field above the line items defaults into this field.

Click the Save icon to save your entries and return to the Prompt.

Verify information using the List to Verify option.

Post transactions using the Post Cash Receipts option.