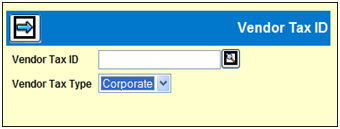

Select Data Base Maintenance|Vendor Tax ID.

Key the Vendor Tax ID code. The format that is used is dependent upon the Vendor Tax Type selected.

Select the Vendor Tax Type from the drop-down list. Selections include: Corporate (Format: 99-9999999), Individual (SSN Format: 999-99-9999), and Other (Open Format for International Tax IDs).

Click the Next icon to display the Detail Window.

Key the first line of the vendor name that will print on the 1099 form. To have this line of information default into the Name 1 for Tape field, click the Recalculate icon.

Key the second line of the vendor name that will print on the 1099 form. To have this line of information default into the Name 2 for Tape field, click the Recalculate icon.

Key the first line of the vendor name for the 1099 tape.

Key the second line of the vendor name for the 1099 tape.

Key the vendor address lines (Address, City, State, Zip Code) to print on 1099 forms and tape output. If you want to pull an address set up in Common Vendor, click <Get Address> and select the vendor whose address you want to use. When you click <Done> information is automatically displayed in the address fields.

Key the Name Control to appear on tape output. The government requires this field to contain the first four characters of the last name of the payee or the first four significant characters of a business name.

If this is a foreign country, click in the Foreign Country check box. Otherwise, leave this box blank to indicate a U.S. address.

From the Payment Type drop-down list, select one of the government prescribed codes to indicate type of payment made to vendor. This allows for printing in the correct area of the 1099 form. If a Payment Type is not selected, a 7 (nonemployee compensation) defaults into this field.

When finished, click the Save icon.